With the Trump Administration,

withdrawing from the WHO as its largest funding agency, the Bill Gates Health

Foundation has become the largest contributor to the WHO, ahead of other

prosperous/rich countries like UK, Germany and Japan.

|

| (Times of India, Delhi Issue, 02.06.20) |

A much as it looks like that now

even the world’s apex, largest and (essentially, efficient) health care

enforcing system is now running majorly on a “capitalist giant’s” pay check,

for some rhyme or reason, coming across this piece of information reminds of

this line Bill Gates delivered at an interview

(https://www.youtube.com/watch?v=ar0ri9NLArs),

When asked about how he would

suggest taxing the ultra-rich, was something on the lines of

Don’t tax the rich (him) on their (his) income, but their (his)

consumption.

So, basically he wants the

government to tax him not on how much he earns but on how much he spends.

And this line my adorable reader,

is what’s going to be the basis for the rest of the discussion.

But before we get into this, the

analysis of things and the “oh, damn”

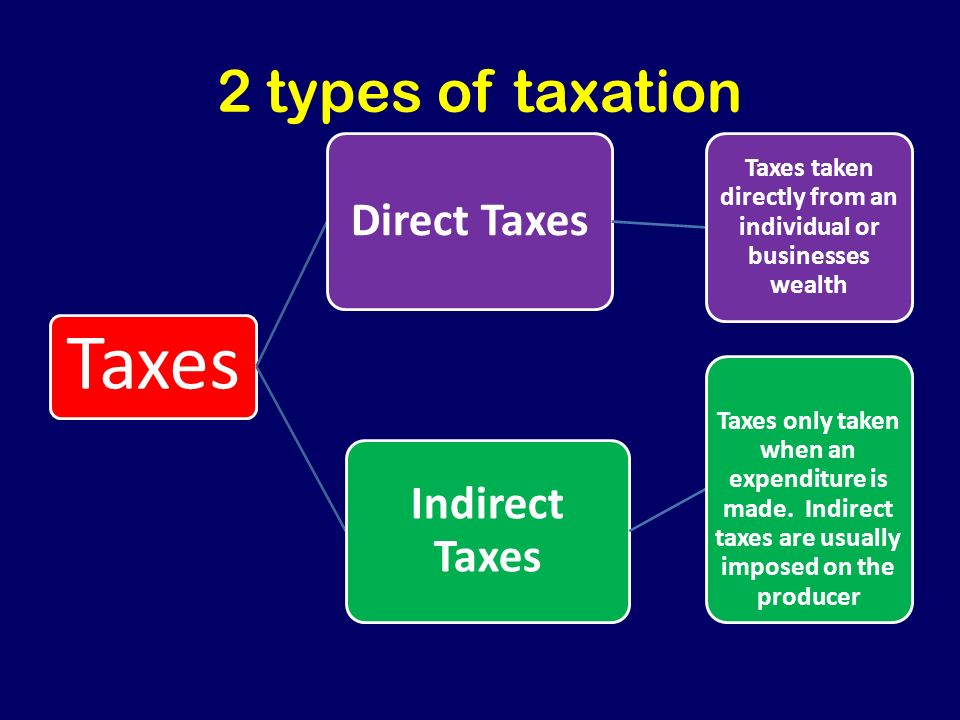

moments that might arise, let’s have a look at how taxes function. Taxes

are usually characterized on the basis of two types:

1.

The way they’re taxed on us, the math of it

2.

They way in which we are supposed to pay them,

the manifestation of it

In both the cases, I’ll be using the income and commodity

example. While income would stand for “what I earn” thing, commodity would

stand for “what I spend”

Type 1: The math of

it

In this category, taxes are of

two kinds, progressive and non-progressive. Generally, (again, very, very

generally)

1. Progressive taxes mean that the tax

amount you’ve to pay rises as the amount of transaction you’ve made (on which

this tax is being levied upon). And so,

a.

If you earn a 100 buck, chances are you fall

under “the income less than 1000” slab, and therefore, you’ve to pay a mere 5%,

i.e. 5 bucks to the government as taxes. And if you earn say, 2000, then you’re

in “the income more than 1000” slab, which essentially charges you a 10% tax

rate, and therefore, you’ve to pay 200 bucks to the government.

b.

Similarly for commodities, if you’re buying say

a loaf of bread, which is a low priced commodity, the tax you’ve to pay on the

purchase would be significantly lesser than the tax you’ve to pay as tax on the

purchase you make on say, a private jet.

2.

Non-progressive

taxes mean that the type of transaction is not necessarily a basis for

which. The reason for this flexibility could be anything, but that’s not we’re

going to be talking about. It involves

the government, so. :P

Like I said, as

the type of transaction no more matters in this case, it’s a little difficult

for both the government agencies and the tax payers to sort of, internalize the

operation of this type of tax system in their respective financial spaces. Sometimes,

it could involve levying a sizeable tax rate such as a 38% on cigarettes,

sometimes a mere 5% on restaurant bills (howsoever, low or high, be it Haldiram

or Taj) and sometimes a complete tax exemption (on things like newspapers and

vegetables). Now, I haven’t ever come across a State agency which has a

“non-progressive” approach to income (the what you earn element) and therefore,

I’m afraid I don’t have an example for the same yet. If you do, then you do you, and let me know in the comments section

below. :)

So basically,

non-progressive simply means the absence

of the “more the more” and “less the lesser” element, exactly opposite to the

progressive taxation system.

Moving on,

Type 2: The manifestation

of it

In this category, taxes are of

two kinds, compulsory and voluntary. Generally, (again, very, very generally)

1.

Compulsory

means no matter how shrude you are, in fact how good you are at this, you’d never ever be able to evade paying for

taxes. I mean, although you’re so smart and probably have the best accountant

in the world (NOT Ben Affleck), you will be paying your due share of taxes each

time you make the transaction.

Say you’ve

earned 1000 bucks, which has left you with 2 choices, either you keep/save it

as an “income” or you spend it on something, probably a nice meal at a take

away. Now, just like me, you’re pretty calculative about things and you

realise:

a.

If you choose to save the money and not spend

it, a tax rate of 20% leaves you with 800 bucks, except, if you don’t report

you income at all, you get to have all of the 1000 bucks. So that makes it a

fairly voluntary (elaborated in the second point), you aren’t compelled/bound

to pay.

b.

If you choose to go for that take away and the

bill stands at 190 bucks, then with the 5% tax rate, the bill comes out to be

200 bucks, right? But then can you skip this tax payment? No, right? Should you

refuse to pay the additional 10 bucks, you would be denied of the service, the

take away in this case. So this makes it pretty, pretty clear that you’re in

fact compelled/bound to pay.

2.

Voluntary

means that the final call that yes, the tax payment would be made totally rests

in your hands. I mean, even though income tax is compulsory, there are probably

millions of people out there who under-report or simply don’t report their

actual incomes at all, right? Yep, tax evasion.

Now in the real world, usually what institutions call:

1.

“direct”

taxes come under the voluntary

category, which if you’re smart enough, gives you a chance to evade them

2.

“indirect”

taxes come under compulsory category,

which howsoever smart and reluctant you are, gives you a very very bleak hope

of evasion. (:

I know enough about tax evasion, but I’m equally

aware about laws and other economic elements, and therefore, I think my moral

compass doesn’t allow me to share things like those with the world, cuz they’re

bad things and NO! you shouldn’t evade taxes. :) period.

Hoping I’ve been able to communicate, again of course, over

simplified idea of how taxes work, let’s go ahead with what Bill Gates said and how

in my understanding (and eventually, yours too) was right at what he said.

Let

me recall what exactly he’d suggested when it came to about taxing the

ultra-rich; he’s said “tax my consumption, not my income”

He said what he had to, what he felt, let’s

dissect this line to the T and understand why he’s right

Let

me ask you this question,

Why

do we, in fact why do the masses often feel in unison that one having higher

tax rates for the rich class?

Simply

because, over the years, a belief system has been artificially manufactured

that the rich class:

1.

Accumulates all the wealth which was duly the

not-so rich classes’

2.

They spend so much, so what’s the problem in spending

a little more as tax

3.

Their choices of luxury somehow seems morally incorrect

considering there still are million, probably billions who aren’t in a

situation to even have single full meal a day, and therefore the outlying

existence seems really unfair and inhuman

I’m hoping I’ve covered almost all aspects, except here’s

the catch, the idea of ultra-rich has historically existed only in two cases;

one wherein the leadership is authoritative, that is a typical case of power

concentration and despotism and second, wherein there’s free forms of market,

that is capitalism (both, as the political as well as the economic system).

With that said, capitalism is cruel, all right? It’ll make your

ass rich for as long as you’re willing to play by its rules, which are just, be selfish, work your own way, don’t

bother to look around. And should you choose to not follow its rules, even

by the least divergence, it is bound to create income disparities and problems,

and its due to this mistake, that the government institutions around the world,

render themselves ineffective and inefficient that we have these 3 point

complaints against the ultra-rich. Trust me when I say this, there is no

country in the world that follows the most perfect capitalist system, but the

US is sure the closest to it, and that’s why it’s at such a pedestal as it is,

that level and quality of prosperity.

Now, considering, Bill Gates and many other rich humans

around the world have in fact countered all he 3 points by their actions, their

contributions back to the society, his idea of taxing the spending is right

because, in that case, in case of expenditure

taxing, the absorption rate is 100%.

That is, say he wants to spend on something, this could be a

commodity such as a take away at a restaurant or an expensive car; or it could

be a service, such as a helicopter ride from DC to LA. In both the cases, HE

HAD TO PAY THE TAXES.

I understand, the

sequence escalated really quickly, give it time, let it sink, blink thrice with

me

Go on

GO

ON

Three, two, one.

BLINK, BLINK, BLINK!

That’s it :)

Getting back, you see, when he earned an income of a humongous

size, probably $10 million, he had the choice

whether to pay his due share of tax or not, except when he wants to spend those

$10 million, he has no choice but a compulsion to pay the tax.

You see what’s happening here? In case of latter, THEY JUST

CAN’T EVADE THE LAW OR THE ETHICAL BINDING that the masses expect out of them.

We complain that the ultra-rich lavishly spends on unnecessary things, luxuries

that aren’t even required to be happy even at that high a level of income

quotient, and therefore, this compulsory, non-evasive, indirect taxation system

is what seems to be the solution to all the problems and complaints in this

domain.

Plus, a 10% tax on 1000 litres of petrol to fuel a Lambo

might just be more than a 5% tax on say, a fancy couple of gallons of aviation

fuel of a private jet, and therefore, even if the ultra-rich switches from a

high-luxury quotient commodity to a low quotient one, the sheer size of the

quantity ensures welfare and fulfilling the need to give back without having a

change to evade.

Now, I think the point of this whole article was to finally

have the background to say this very last^ line.

Now that we’re on the same page about yet another thing,

I’ll have you some time to think about this, and let me know

in the comments section whether what Bill suggested seems fair and reasonable

or not.

Until then,

This is Mayul

Stay hydrated :))))))))))))

All Image Sources: Google Images

Comments

Post a Comment